By Sharon Golden, Regional Extension Agent

Samantha Dopson and Makenzie Roller are teenagers who don’t have to worry about things like budgeting and paying bills.

That is until Reality Check.

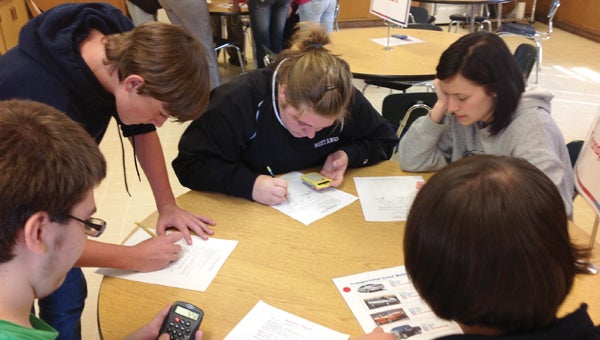

Students from Samantha Robinson’s classes at Verbena High School got the chance to experience what the future will be like as adults.

Reality Check is a hands-on, real-life budgeting simulation that gives young people the opportunity to take a brief glance into the future in a fun and exciting way.

Participants are encouraged to make healthy and wise lifestyle choices similar to those adults face on a daily basis.

Reality Check addresses financial management on a level that young people can understand.

They learn the importance of managing money and how to provide for themselves and their families.

Participants assume they are 25 years old, living on their own and are the primary support of their household.

Each student is randomly assigned an occupation that includes the level of education required for the occupation plus the yearly, monthly, gross and net salary.

They are also assigned a family scenario: married, single, with or without children. The lucky ones have twins.

As a teachable moment before the simulation begins, students are made aware that they no longer live in their current community; they have moved out of state. This is important in case they get the idea that parents or grandparents can keep the kids.

The differences between gross and net, debit and credit are explained. It is revealed to them what and why income taxes are taken from their salaries and how dependents affect their take-home pay.

Students are given an opportunity to explore each other’s occupation and income level and compare the differences as they relate to level of education, career choice and income.

The importance of saving for the future is discussed, and they are asked to set a savings goal based on their current simulated income. They are taught to write a check and how to track spending using a checking account ledger.

Next, they proceed through “Realville” by way of simulation booths set up as storefronts. At these booths, students buy homes, cars and insurance and make their first payment. They buy groceries, put their kids in daycare and more. When the money starts to run out, they even get a second job or go back to school for more education. These are all part of the education process as students learn to prioritize their financial decisions.

The 2011 Teens and Money Survey conducted by Charles Schwab & Co. Inc. reports most teens are interested in learning about money.

Eighty-six percent said they would rather learn about money in class before making mistakes in the real world.

Seventy-five percent said that learning more about money management, including budgeting, saving and investing, is one of their top priorities.

The students from Robinson’s family and consumer science class and life skills class went from store to store to make their choices, while being coached about the products available for purchase.

“It’s hard being grown up,” seventh grader Johnathan Dopson said.

Eighth grader Mayrani Lopez agreed.

“This is like real life. I am shaking,” Lopez said.

After the simulation was complete, students were asked to reflect on what they learned. Most students agreed that it was a great experience and said they will share this information with parents and recommend it to their friends.

Reality Check is one of many programs focused on promoting financial literacy. For more information on this or other financial topics, contact the Chilton County Extension Office in Clanton at (205) 280-6268.

Sharon Golden is a Regional Extension Agent in the area of consumer science and personal financial management for the Alabama Cooperative Extension System.